Spring Branch ISD Information

What happens in Austin impacts all of us.

As the Texas Legislature gears up, changes to education funding and programs will be more clearly defined. SBISD, in the meantime, will continue to communicate with Legislators and our community about how decisions in Austin impact our schools, our students, our employees and the local community.

Our Board of Trustees have approved the legislative priorities for the 88th Session - Click Here

What were the legislative priorities for SBISD in the 87th Session of the Texas Legislature? Click Here

SBISD SCHOOL FINANCE ADVOCACY TEAM INFO

RECAPTURE

(Revenue in excess of entitlement)

Q: What is “recapture”?

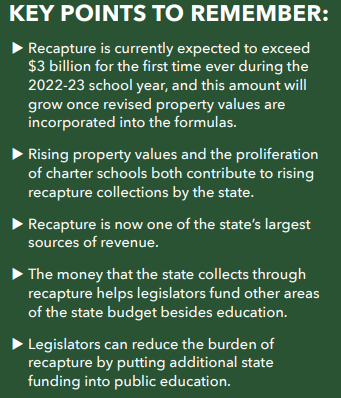

In a 1993 response to court rulings calling for a more equitable school funding system, the Legislature began requiring school districts with higher levels of property wealth per student to pay recapture. Recapture is the process through which these districts send some of their local property-tax revenue to the state. The process is often referred to as Robin Hood. The intent of recapture is to help all school districts have roughly similar amounts of money to spend per child. But over time, recapture has grown considerably, and today recapture payments have grown so large that the state uses those dollars to support a considerable amount of the state’s funding obligation for education, therefore freeing up state funds to be spent on areas of the state budget other than education. https://www.txsc.org/texas-school-finance-faqs

Because SBISD is property wealthy - we are a “recapture” district.

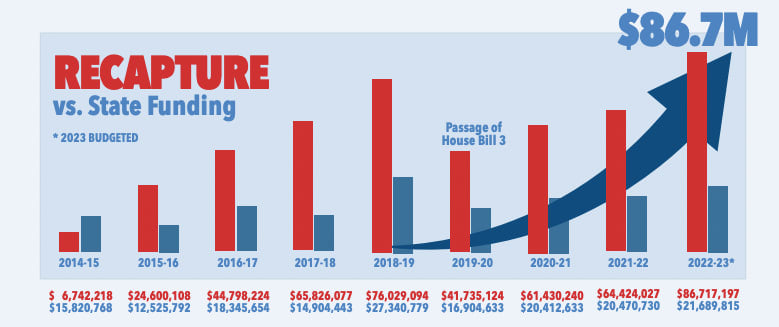

SBISD’s “recapture” recently decreased from $84M to $39M (about 12% of local tax revenues) for fiscal year 2020 due to the passage of HB3 in the 86th legislative session. However, it is back up to $60M for 2021 and for 2022, the estimate is $51M and back to $64M in 2023 - which is right back where we were in 2017.

Q: Why can’t bond monies be used to pay for more teachers?

Approved by voters, bond funds finance capital improvements and are paid back over time. Bond proceeds can only be spent on what voters approve, and by law can’t be used for operational expenses like salaries. Bond monies are not subject to recapture.

Q: How does SBEF (Spring Branch Education Foundation) come into all of this?

Founded in 1993, the Spring Branch Education Foundations through private funding, helps enhance the quality of education. SBEF raises funds only for SBISD. SBEF Funds are supplemental to the district. They can not be used as part of the district’s general expenditures and the district has no control over the grants. A Foundation Board committee reviews the applications to determine how the money can best be used in the district.

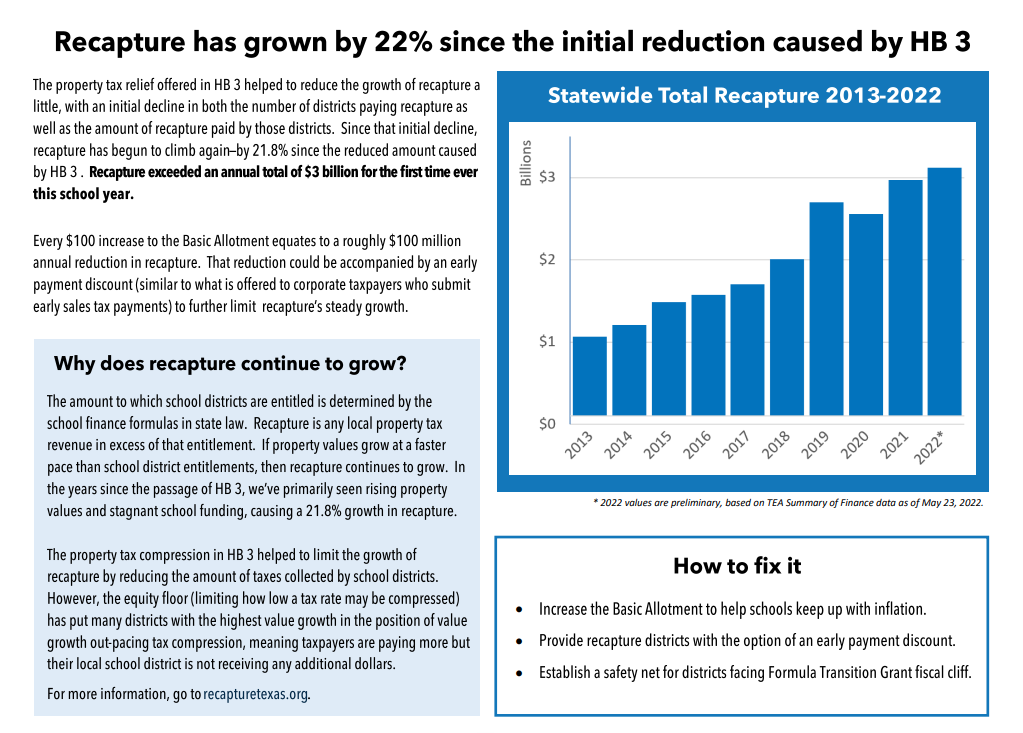

Q: But didn’t HB3 passed in the 86th session fix recapture?

No - it essentially kicked the can down the road. HB3 didn’t ‘fix’ school finance. Read more below.

In a 1993 response to court rulings calling for a more equitable school funding system, the Legislature began requiring school districts with higher levels of property wealth per student to pay recapture. Recapture is the process through which these districts send some of their local property-tax revenue to the state. The process is often referred to as Robin Hood. The intent of recapture is to help all school districts have roughly similar amounts of money to spend per child. But over time, recapture has grown considerably, and today recapture payments have grown so large that the state uses those dollars to support a considerable amount of the state’s funding obligation for education, therefore freeing up state funds to be spent on areas of the state budget other than education. https://www.txsc.org/texas-school-finance-faqs

Because SBISD is property wealthy - we are a “recapture” district.

SBISD’s “recapture” recently decreased from $84M to $39M (about 12% of local tax revenues) for fiscal year 2020 due to the passage of HB3 in the 86th legislative session. However, it is back up to $60M for 2021 and for 2022, the estimate is $51M and back to $64M in 2023 - which is right back where we were in 2017.

Q: Why can’t bond monies be used to pay for more teachers?

Approved by voters, bond funds finance capital improvements and are paid back over time. Bond proceeds can only be spent on what voters approve, and by law can’t be used for operational expenses like salaries. Bond monies are not subject to recapture.

Q: How does SBEF (Spring Branch Education Foundation) come into all of this?

Founded in 1993, the Spring Branch Education Foundations through private funding, helps enhance the quality of education. SBEF raises funds only for SBISD. SBEF Funds are supplemental to the district. They can not be used as part of the district’s general expenditures and the district has no control over the grants. A Foundation Board committee reviews the applications to determine how the money can best be used in the district.

Q: But didn’t HB3 passed in the 86th session fix recapture?

No - it essentially kicked the can down the road. HB3 didn’t ‘fix’ school finance. Read more below.

LEARN MORE AT

The Texas SCHOOL COALITION

|

The Texas School Coalition exists to ensure Texas public schools can provide every student an excellent education, local decision-makers have meaningful discretion over local funds, and the school finance system balances sustainable state and local investments in the best interests of students and taxpayers.

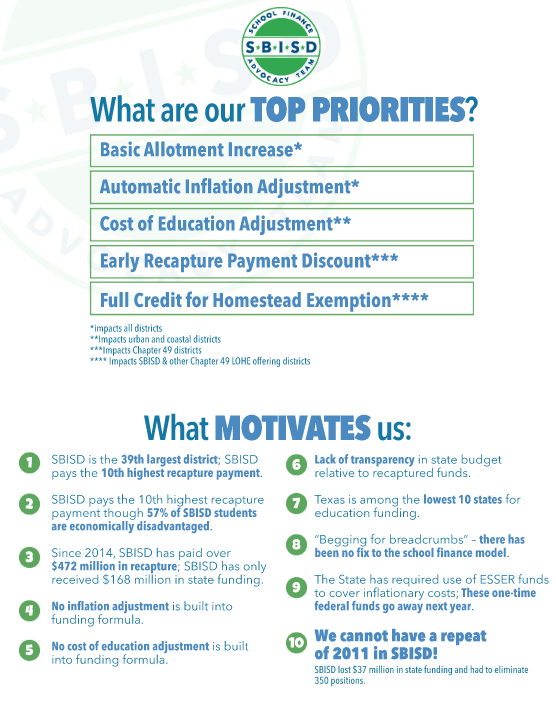

SBISD is a member district of the Texas School Coalition along with many of "Chapter 49" districts. |

From the Texas School Coalition testimony July 2022 - read the entire testimony here www.txsc.org/school-finance-testimony-in-house/

HOW DOES RECAPTURE WORK EXACTLY? |

Learn more at RecaptureTexas.org